There are worries about proposals allowing companies to make gains from the pension funds utilized by approximately nine million people in Britain.

The proposed modifications to 'defined benefit' plans would allow 'excess' funds to be withdrawn for profitability or reinvested.

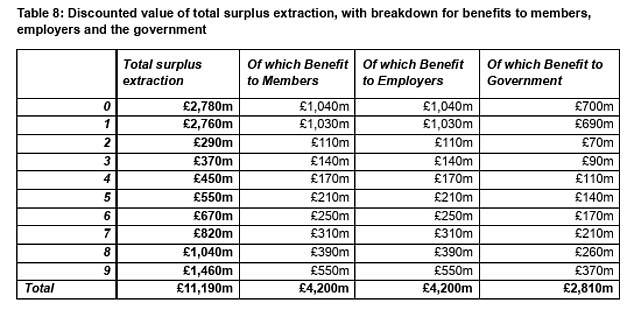

The government contends that this action will liberate £11.2 billion over the coming ten years, which would then be distributed among members partially.

This move would also result in a £28 billion bonus for the Treasury, since the withdrawal would be subject to taxation.

Nevertheless, the impact assessment for the Pensions Bill recognized that the restructuring eliminates a 'buffer,' which could increase the likelihood of schemes 'facing difficulties.'

Defined benefit pension schemes – including final salary and career-average plans – have declined in the private sector since the 1980s.

They have mostly been supplanted by 'defined contribution' plans, wherein both the employee and employer contribute to a particular 'account' to finance retirement.

The impact assessment for the Pensions Bill stated: "Should schemes opt to alter their regulations to facilitate surplus withdrawal, it would impose additional indirect costs on members through a heightened probability of individuals not being able to receive their complete pension entitlements."

A scheme surplus may serve as a financial buffer for members, helping to cover unforeseen expenses or investment losses within the plan.

'If this cushion were removed, the plan might find it harder to fulfill its commitments to participants, particularly during periods of financial strain or economic upheavals.'

The document emphasized that plans would need to fulfill certain criteria to access extra funds, aiming to 'safeguard participants.'

Consequently, the likelihood of members failing to receive their benefits entirely was deemed 'very low.'

The assessment stated, 'Employers with a frail covenant might enhance their financial standing by utilizing a surplus; however, this could also leave the pension scheme at risk of being underfunded.'

If sponsoring employers of underfunded plans were to face insolvency as well, these plans could be transferred to the PPF, which would increase its financial obligations and might result in members receiving reduced benefits.

'Taken as a whole, it is presumed that the heightened chance of members not getting their full benefits is quite minimal due to the crucial oversight role played by the trustees concerning any decisions made.'

The Pension Security Alliance (PSA), comprising the advocacy organization Silver Voices, informed the Telegraph: "It is alarming to discover that government employees have advised ministers that implementing these proposals might cause certain pension funds to find it difficult to fulfill their commitments regarding pension payments."

Steve Webb, a partner at pension consultancy firm LCP, stated, "There truly is considerable 'excess' funds trapped within these plans, surpassing the amount required to securely provide pensions."

If managed properly, part of this funding could be utilized to enhance the pension benefits for individuals enrolled in these programs (such as providing improved protection against inflation) and strengthen the standing of British businesses (which have contributed the majority of the funds).

'It should be noted that companies do not have free rein to access the fund; approval from the trustees must first be obtained. Their role is to safeguard the interests of the members.'

Read more

Read more

Post a Comment