- In October 2023, Aussie purchased her initial house.

- She got a surprising letter regarding her mortgage payments.

- EXPLORE FURTHER: Monique leased a space... yet she was enraged upon arrival

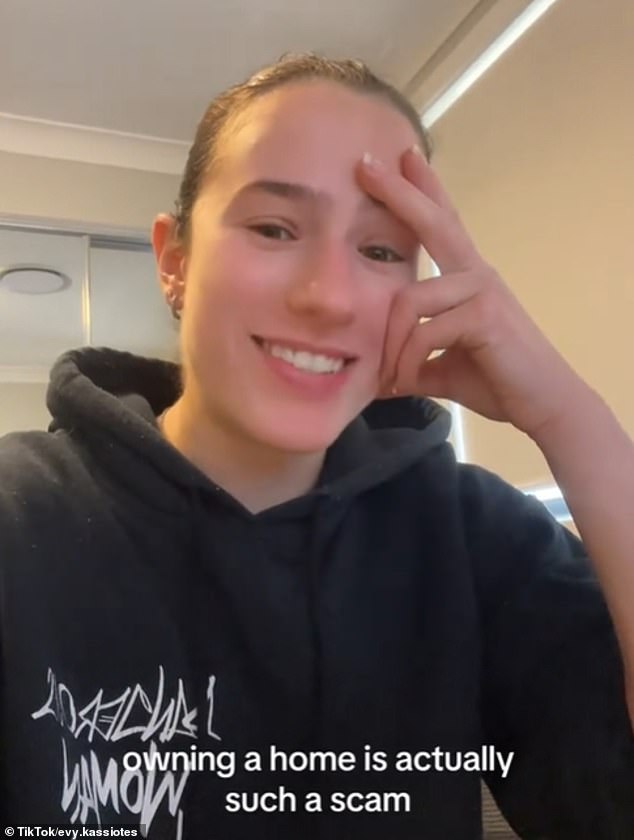

An Australian homeowner has labeled buying a house as a 'fraud' following receipt of a startling letter just under two years since acquiring their initial property.

Evy Kassiotes, aged 25, purchased her inaugural property in Sydney In October 2023, she was shocked to find out how small a portion of her mortgage she had managed to pay off after 19 months.

The bodybuilder, who is presently employed at two positions, expressed her disappointments about TikTok And she mentioned that she realized owning a home was a privilege, yet it seemed as though she would never escape the burden of her mortgage payments.

'She claimed in the video that owning a home is essentially just a scam.'

Ms. Kassiodes mentioned that she had initiated a 'progress letter for the loan,' revealing her payment progress, but this made her feel like she was being 'tricked.'

"What do you mean we have only paid $3,000 since October 2023? It’s already May 2025," she remarked.

The person from Sydney mentioned that they were surprised by how significantly their payments were reduced by the interest on the loan and how insignificantly it affected the initial sum.

Miss Kassiotes, similar to many young Australians striving to secure their first home, faces an intense challenge due to a severe shortage of houses driving up both competition and costs, along with extremely high-interest rates aimed at curbing inflation.

Viewers who commented on her video concurred, stating that purchasing homes had become too expensive.

One viewer commented, "Purchasing your own house is nothing but a big fraud."

'Every fee, every bit of interest, every repair and maintenance task, along with all the council rates and water charges—it seems like even after paying everything off, you're still stuck with council rates and ongoing repairs, among others.'

'Complete theft! I can’t bear to check anymore,' another commented.

"Wait until you calculate how much you will end up paying for that loan over a period of 30 years," someone mentioned.

Mrs. Kassiodes responded: "I recall I made a spontaneous calculation and nearly had a heart attack."

Someone else mentioned that their focus was on home lending and mortgages throughout the day, and despite this, they still felt disillusioned because of how small the amount they had managed to pay off remained.

A different advisor suggested that the 25-year-old should consider setting up an 'offset account' to lower the interest rate on her home loan.

'We have been in our home for almost two years now, but together we still have a bit more than 26 years ahead of us,' they mentioned.

Simply by having some funds in our offset account, we've reduced the repayment period by 1.5 years without paying anything extra.

An offset account refers to a distinct banking account that is connected to your mortgage for your house.

Homeowners have the option to deposit their salaries, savings, and conduct daily transactions through this account. The balance within this offset account is subsequently utilized to decrease the interest payable on their home loan.

Ms. Kassiotes mentioned that although she already possessed an offset account, it did not lessen the impact of the minimal advancement she had achieved towards her loan.

House prices have reached unprecedented levels and are expected to keep rising due to reduced mortgage rates, which encourage more purchasers to return to the real estate market because of insufficient new home construction.

In May, the average home in Australia had a value of $831,288, marking a 0.5 percent increase from the previous month, according to data provided by property analysis company Cotality, previously known as CoreLogic, earlier this month.

Each capital city along with the consolidated areas showed an increase of at least 0.4 percent, marking a widespread rebound primarily due to purchasers having greater confidence in their buying power.

"Without a doubt, interest rates have positively impacted housing markets since February," stated Tim Lawless, the research director at Cotality.

But I definitely wouldn’t describe the pace of expansion as outstanding. A growth rate between 0.4 percent and 0.5 percent is far more manageable compared to what we experienced from early 2023 through mid-2024.

The trend was reflected in the PropTrack Home Price Index report, which was released this month as well and is compiled by REA Group.

Eleanor Creagh, the senior economist at REA Group, stated that this pattern would likely persist because of insufficient production of new homes, an increase in population, and specific benefits offered to purchasers.

"In conjunction with interest rates remaining low, these elements are expected to propel further expansion for the rest of 2025," she stated.

Following a brief and superficial decline towards the end of 2024, the rebound in prices was largely attributed to market sentiment rather than an actual enhancement in affordability or increased access to credit, as noted by Mr. Lawless, despite interest rates remaining in a constraining range.

'We have observed historically that consumer confidence and housing activity typically move together.'

Read more

Post a Comment