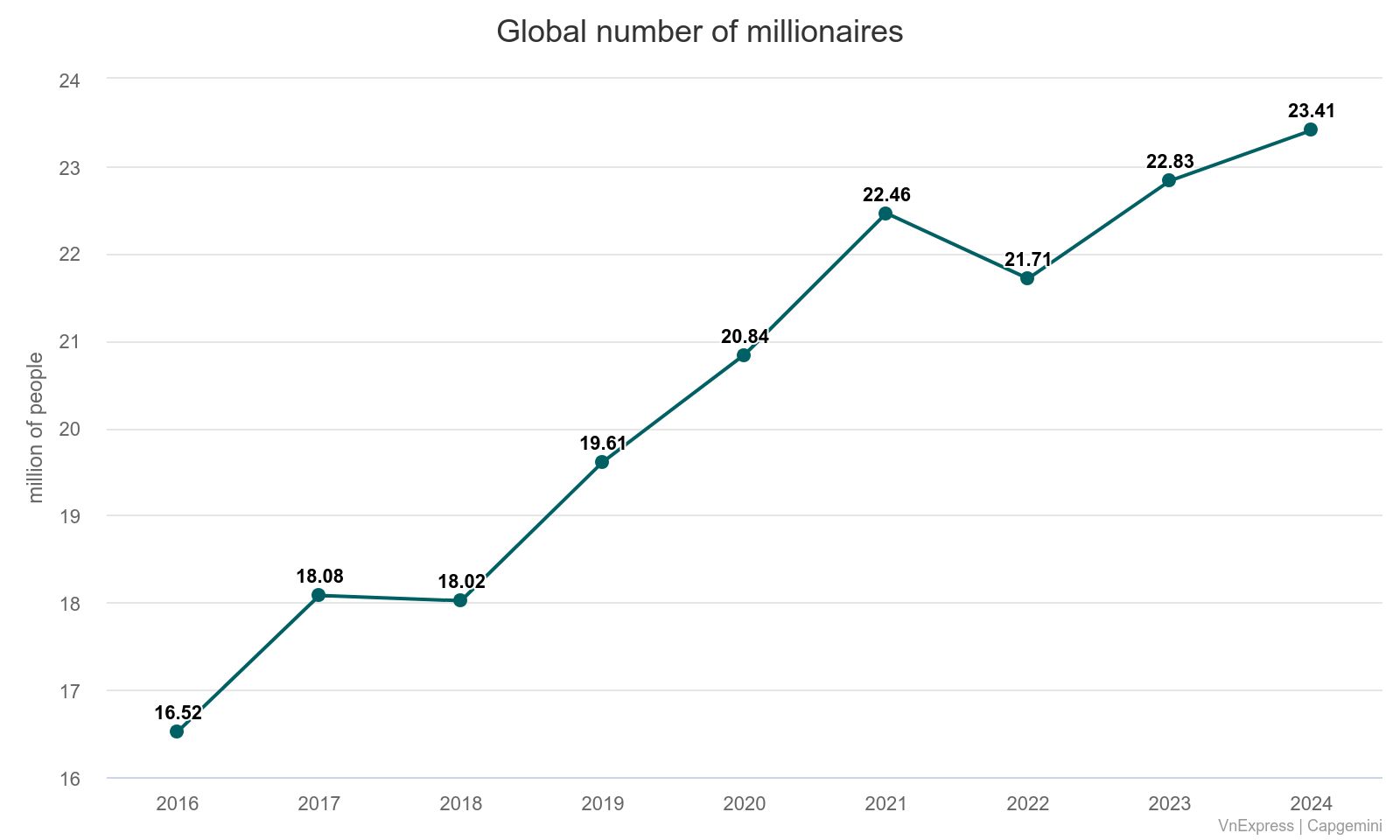

Last year, the globe saw a record high of 23.4 million millionaires, thanks largely to robust gains in stock markets even as economies faced significant instability.

The number increased by 2.6% since 2023. This group of millionaires held a total of $90.47 trillion in wealth, which represents an increase of 4.2%. The findings come from a report published by Capgemini, a company specializing in IT services and consultancy.

The expansion was mainly driven by increases in American stock portfolios.

In the United States, there was an increase of 562,000 new millionaires, representing a 7.6% growth. This surge can be attributed to excitement surrounding artificial intelligence and decreases in interest rates, which fueled substantial gains in the U.S. stock market.

The largest improvements were observed among ultra-high-net-worth individuals — individuals who have at least $30 million in investible assets — saw their wealth increase by almost 12% in the U.S.

In the Asia-Pacific region, India and Japan stood out, each experiencing a 5.6% growth and gaining 20,000 and 210,000 new millionaires, respectively.

On the contrary, China experienced a decline, as evidenced by a 1% reduction in the number of high-net-worth individuals.

Kris Bitterly, who leads Citi Global Wealth at Work, stressed that increased involvement with alternative investment options might be essential for future development, especially for wealthy individuals looking to manage their assets in poorly performing domestic markets.

"As Bitterly pointed out, many investors currently have asset allocations where they are considerably underinvested in alternative assets," according to the report. Bloomberg .

Alternatives provide "distinctive chances that cannot be found in public markets and which you wish to include in your portfolio," she noted.

Capgemini also mentioned that wealth management companies are proactively getting ready for a new phase of wealth transfer, during which $83.5 trillion is expected to change ownership over the coming twenty years.

The significant shift in wealth distribution will mark a crucial point for the sector. Even though global riches are increasing, 81% of those who receive an inheritance intend to change their financial service providers within twelve to twenty-four months after inheriting funds,” stated Kartik Ramakrishnan, CEO of Capgemini’s Financial Services Strategic Business Unit.

"He noted that the upcoming generation of high-net-worth individuals comes with significantly different expectations compared to their parents." He further stated that the potential loss of these dissatisfied clients poses considerable risks to the global wealth management industry.

The survey by Cap Gemini, carried out in January 2025, collected feedback from numerous wealth managers as well as more than 6,000 high-net-worth individuals spanning 71 nations.

Post a Comment