By Ebenezer Chike Adjei Njoku

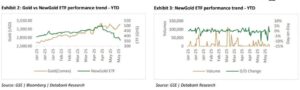

Following weeks of underwhelming performance, the NewGold ETF, which is traded on the Ghana Stock Exchange (GSE), is set for an upturn as global gold prices experienced a significant uptick at the start of June 2025.

The surge in spot gold prices, fueled by a declining US dollar and increased geopolitical tensions, has boosted investors' optimism and might provide some respite for owners of the gold-backed ETF, which has seen a 20 percent drop since early May.

Gold jumped over two percent during Monday's trading session, reaching $3,372.13 per ounce—the highest level in three weeks—driven by increased safe-haven buying due to escalating unrest in the Middle East and conflicting indicators from U.S. economic reports. This upsurge offset a 2.3 percent drop compared to the previous week on COMEX, where gold had closed at $3,312.10.

The NewGold ETF, designed to mirror the value of actual gold bullion, showed a drop of 6.09% during the previous week, closing at GH¢350.86 after reflecting the downturn seen around late May. This decrease became more pronounced due to low trading activity; notably, the typical number of shares traded each day decreased by 16.78%, settling at an average of 4,750 units per day, while the overall volume for the week fell by 24.5% to reach GH¢8.25 million.

"The gap between initial safe-haven movements and subsequent technical selling later in the week indicates that domestic investors continue to be cautiously strategic, looking for more definitive signs regarding inflation trends and the direction of central bank policies," noted analysts from Databank Research in an early-June report marking the start of the first trading week in June 2025.

gold

Gold's prospects continue to be influenced by inflation figures and the direction of U.S. Federal Reserve policies. The conflicting Personal Consumption Expenditures (PCE) inflation data from last week reduced anticipation for immediate interest-rate reductions. An unexpectedly robust core PCE report maintained high real yields, diminishing gold's attractiveness. However, the weakening of the U.S. dollar by 0.5 percent against leading global currencies on Monday shifted the story back in favor of gold.

Local investors have keenly experienced the effects of international developments. The asset started the year valued at GH₵390.5 and peaked at 508.31 on Tuesday, April 22, 2025; however, the ETF has lost 10.2% of its worth since the beginning of the year and now sits within the lowest 20% of performers on the Ghana Stock Exchange based on yearly returns up until today. Nonetheless, even after this decline, NewGold stays as the 17th largest company listed on the exchange with a market cap of GH₵1.02 billion, representing approximately 0.76% of the entire equities market on the GSE.

This ETF is designed to offer investors straightforward access to gold via shares that correspond to one-tenth of a gram of the actual metal. Supported by bullion stored in LBMA-compliant safes, the fund serves as protection against fluctuations in currency values, rising prices, and worldwide economic unrest—critical factors in today’s broader economic landscape.

The latest surge in gold prices occurs amid the improved performance of local currencies. Last week, the cedi (GH₵) emerged as the top performer on the interbank market, appreciating by 6.52% against the U.S. dollar to settle at an average rate of 10.95/GH₵. This appreciation of the cedi has somewhat reduced the upward momentum for the GH₵-priced NewGold ETF recently.

Databank Research pointed out that if offshore investors keep bringing their profits back to Ghana or if imports increase significantly, the cedi might experience further downward pressure.

"A weaker currency scenario, particularly when it exceeds the GH₵11.30/US$ level, would render the NewGold ETF more appealing as a protective measure," the statement further noted.

Attention from investors will now shift towards future U.S. economic reports and statements from Federal Reserve members. The markets are highly attuned to signs suggesting that core PCE inflation—the measure favored by the Fed—might drop under 2.2% annually. This decline could alleviate stress on real yields, potentially renewing investor enthusiasm for gold.

Meanwhile, physical demand from Asia – a key pillar of bullion support – has shown signs of weakening. In India, demand cooled with the traditional wedding season ending and rising local prices. Wholesale premiums fell from US$49 to US$31.

On the Shanghai Gold Exchange in China, premiums tightened to $15, indicating an excess supply locally. Although Asian market demands might restrict gold’s short-term gains, sentiment-led investments and acquisitions by central banks still provide stability, as indicated in a note from Databank Research.

Nationally, the Bank of Ghana has seen substantial growth in its gold reserves due to its Domestic Gold Purchase Program. By the close of April 2025, the central bank possessed 31.37 metric tons of gold—approximately 1,008,837 troy ounces—with an estimated value of around GH₵46.3 billion. This represents a significant increase from the 8.78 metric tons reported in 2023.

As the GSE’s Composite Index commenced trading in June 2025, it was noted to be 25.81 percent above the starting level for the year.

Provided by Syndigate Media Inc. ( Syndigate.info ).

Post a Comment