The Trump administration’s sudden reduction of tariffs on Japanese automobiles to 15% from the 16th (local time) has left South Korea’s automotive industry facing a “triple crisis” in the U.S. market. While Korean cars, which had zero tariffs under the Korea-U.S. Free Trade Agreement (FTA), have been subject to 25% tariffs since April, Japanese vehicles now face lower tariffs than ours.

In two weeks, subsidies for U.S.-manufactured electric vehicles (EVs) will also end. This is a setback for Korean automakers, who have been aggressively targeting the U.S. EV market. Additionally, the construction of a joint battery factory by Hyundai Motor and LG Energy Solution in Georgia, U.S., has been delayed by at least two to three months due to a large-scale detention and arrest operation by U.S. immigration authorities. Disruptions in battery procurement are now inevitable. Korean companies are unable to avoid weakened price competitiveness and declining profitability in the U.S., their largest market. Critics argue that without diplomatic solutions from the government, these challenges are beyond the capacity of individual firms to handle.

◇Tariff Impact Intensifying

The biggest challenge is tariffs. Before Trump imposed 25% tariffs on imported cars in April, Korean automakers had a cost advantage over Japanese rivals, which paid 2.5% tariffs. However, the situation has now reversed: Korean cars face tariffs 10 percentage points higher than Japan’s.

The problem is that raising prices to offset tariffs is difficult. If the cost advantage disappears, the current market share of around 10% could plummet. Ultimately, Korean companies have no choice but to accept reduced profitability. According to SK Securities, Hyundai Motor and Kia are expected to see a profit decline of approximately 1.7 trillion Korean won in the third quarter due to tariffs.

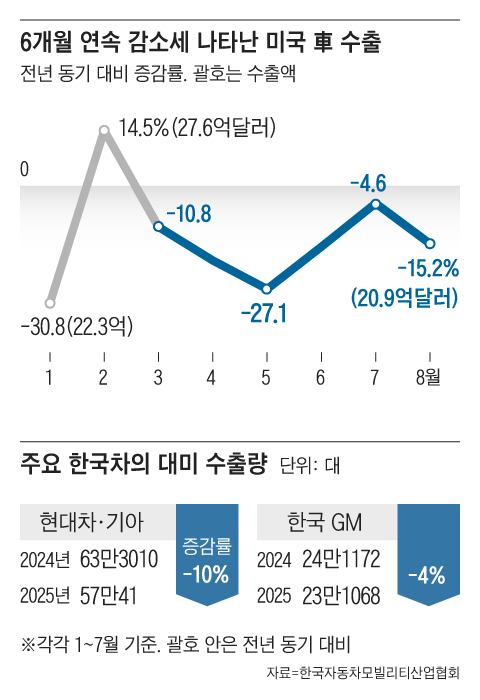

GM Korea is also in crisis. About 90% of its annual production of 500,000 vehicles is exported to the U.S., but tariffs have effectively eroded its export competitiveness. GM Korea’s focus on small cars, popular with price-sensitive consumers, makes it difficult to raise prices despite higher tariffs. The company has no choice but to absorb the burden or reduce exports. In fact, GM projected in May that tariffs could reduce profits by about $2 billion (2.7 trillion Korean won) this year. From January to July, GM Korea’s exports to the U.S. fell by 4% to 231,068 units compared to the same period last year.

The worst-case scenario is prolonged tariffs. Cases of the UK and Japan show that even after agreements, tariff reductions took over 50 days. With Korea-U.S. tariff negotiations facing difficulties, an immediate resolution seems unlikely. Some worry the current situation could persist for a significant period.

◇Chasm in the U.S. Market Could Widen

The end of the U.S. government’s $7,500 subsidy per EV in two weeks is another setback for Hyundai Motor and Kia. As of the first half of this year, Hyundai and Kia ranked third in U.S. EV sales, behind Tesla and GM. They have been outperforming non-U.S. rivals like Japan’s Toyota and Germany’s Volkswagen in the EV sector.

Hyundai and Kia had prepared to accelerate their U.S. EV market strategy by completing a $10 trillion Korean won EV factory in March. They had anticipated full subsidy benefits this year. However, the subsidy cutoff has dashed these hopes. Experts analyze that the subsidy’s elimination itself will shrink the U.S. EV market. This could dim the impact of Hyundai’s massive investments. The EV market, already in a “chasm” (a temporary demand stagnation), could freeze further.

The battery factory Hyundai Motor and LG Energy Solution were building in Georgia has also faced unavoidable delays due to the detention crisis. Skilled workers from partner companies have returned home, and replacements are unavailable. If battery procurement issues delay EV production, the costs will likely fall entirely on Hyundai. Local demands in the U.S. for increased hiring of Americans make it difficult to guarantee a quick resolution to visa problems.

The three challenges Korean companies face in the U.S. are complex issues that individual firms cannot resolve alone. An automotive industry official said, “Tariffs, EV subsidies, and visa issues are all government-related problems, leaving companies stuck with no clear solutions.”

Post a Comment