As follow-up negotiations on the South Korea-U.S. tariff agreement have stalled, the timing for the reduction of tariffs on automobiles and parts exported to the U.S., a key point of the negotiations, is expected to be further delayed than anticipated. Amid this, Japan’s tariffs on automobiles and parts are expected to drop to 15% starting tomorrow, raising concerns that Japanese cars may become cheaper than Korean ones in the U.S. market.

◇ Japan: Automobile Tariffs to Drop from 27.6% to 15% Tomorrow

According to foreign media reports on the 15th, the Japanese government and industry expect that tariffs on Japanese automobiles and parts exported to the U.S. will be reduced from the current 27.5% (2.5% basic tariff + 25% item-specific tariff) to 15% starting tomorrow (the 16th).

The two countries reached a trade agreement in late July, under which they would reduce reciprocal tariffs and automobile/parts tariffs to 15% respectively, in exchange for Japan establishing a $550 billion investment fund in the U.S. Since then, the Trump administration has applied 15% reciprocal tariffs starting August 7th, but has delayed the implementation of the automobile/parts tariff reduction, another key component of the agreement.

After signing a memorandum of understanding (MOU) with Japan stating that Japan would invest $550 billion in various fields critical to economic security, including semiconductors, energy, artificial intelligence, and key minerals, during President Trump’s term, the U.S. administration officially signed an executive order on the 4th of this month to reduce item-specific tariffs on Japanese automobiles and parts to 15%. This content was officially published in the Federal Register on the 9th.

The executive order also stated that ‘within seven days of this order being published in the Federal Register, the U.S. Department of Commerce must separately publish revised tariff classifications in the Federal Register.’ Accordingly, Japan’s tariff negotiation representative, Economic Revitalization Minister Ryosei Akazawa, stated, ‘The reduction of automobile and parts tariffs will officially take effect from the 16th.’

◇ South Korea’s Competitiveness Inevitably Weakened

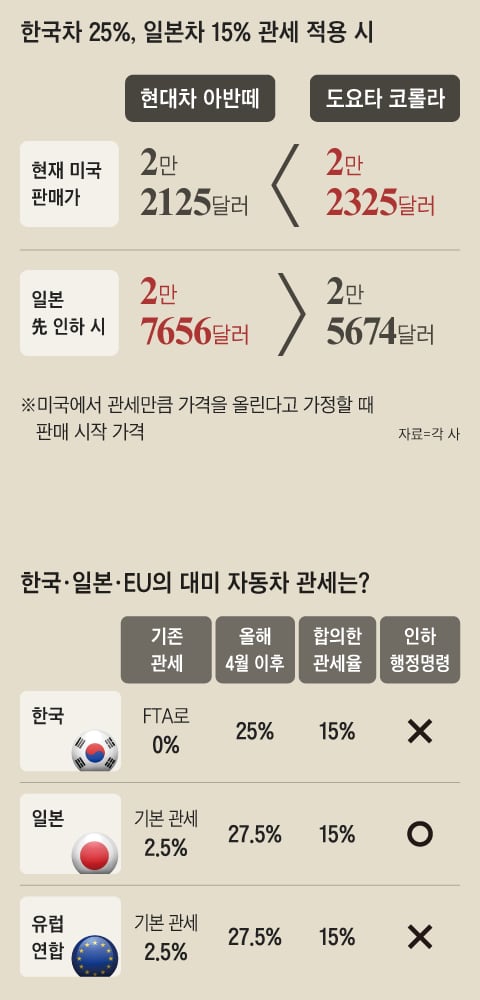

If the U.S. implements a 15% tariff on Japanese finished vehicles, South Korea’s finished vehicle industry is expected to be hit directly. Prior to April of this year, South Korean vehicles benefited from tariff-free treatment under the South Korea-U.S. Free Trade Agreement (FTA), allowing them to have higher price competitiveness compared to Japanese and European vehicles, which were subject to a basic tariff of 2.5%.

However, since the Trump administration introduced a policy in April to impose a 25% tariff on all imported vehicles regardless of FTA status, Hyundai Motor and Kia have suffered impacts, including a reduction of 1.5 trillion Korean won in operating profit during the second quarter (April-June) of this year alone.

If Japan is subject to a 15% tariff starting tomorrow while South Korea remains at 25%, creating a ‘reversal’ situation, it is expected that the prices of Korean and Japanese vehicles could also reverse.

Currently, the Hyundai Motor Avante starts at $22,125 in the U.S., cheaper than Toyota’s Corolla ($22,325). However, if prices are adjusted to reflect the tariffs imposed on South Korea (25%) and Japan (15%), the Avante would rise to $27,656, making it more expensive than the Corolla ($25,674). Maintaining current prices would inevitably continue to reduce operating profits.

Initially, the industry had expected automobile tariffs to be formally reduced after about two months, based on the case of the UK, which was the first to reach a trade agreement with the U.S. In May, the U.S. agreed to reduce tariffs on British vehicles to 10% for up to 100,000 units annually, but it took approximately 53 days for the agreement to take formal effect. Since Japan concluded its trade negotiations on July 22nd, the implementation on the 16th would also take about two months.

A bigger issue is that the government is in a situation where it is difficult to prioritize the reduction of automobile and parts tariffs. While the U.S. is reportedly pressuring for a similar form of ‘investment in the U.S. worth $350 billion’ as with Japan, there is strong public opinion that it is irrational to carry out foreign investments worth hundreds of billions of dollars within the short period of President Trump’s term solely to export automobiles to the U.S.

Following the dispatch of Minister of Trade, Industry and Energy Kim Jung-kwan last week, the government is continuing follow-up negotiations by urgently sending Trade Minister Yeo Han-koo to the U.S. today.

※ This article has been translated by Upstage Solar AI.

Post a Comment