The positive aspect: Lower-cost batteries lead to more affordable electric vehicles. The downside: China’s battery expenses continue to decrease at a quicker pace than our own.

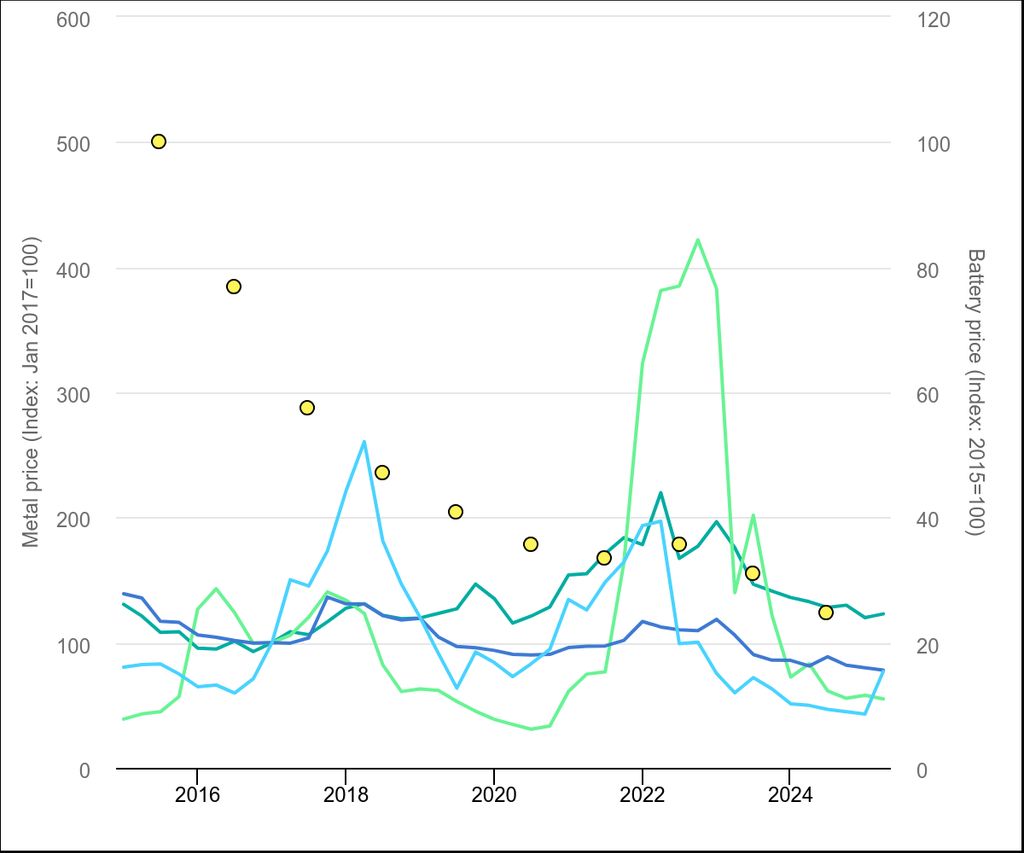

- According to a report by the International Energy Agency (IEA), prices for lithium-ion battery packs decreased by 20% in 2024, marking the biggest decline since 2017.

- More affordable batteries result in less expensive electric vehicles, and these cars and trucks continue to be the primary factor driving battery consumption.

- China's cost edge is expanding compared to the rest of the globe.

The battle for a zero-emission future in transportation essentially boils down to a struggle over batteries. Should battery costs—which represent the largest expense component of any electric vehicle—stay elevated, electric vehicles will continue to be pricey. However, should batteries become more affordable and readily available through local production or procurement, this could lead to lower overall prices.

Tesla identified this early on through its Gigafactory in Nevada. This is also why other car manufacturers such as General Motors , Toyota and Ford are establishing battery facilities independently—with mixed outcomes so far.

But as every automaker, battery supplier and energy provider races toward that future, here's some good news: global prices for lithium-ion battery packs fell 20% in 2024, based on a recent research findings According to the International Energy Agency (IEA), this represents the most significant individual price decrease since 2017.

The decline in lithium prices can be attributed to heightened competition, greater output, and rising consumption. The report noted that lithium prices fell by almost 20% in 2024, mirroring levels seen at the close of 2015, even though the demand for lithium in 2024 was approximately six times higher compared to 2015.

Low prices for essential minerals are attributed to present excesses, providing short-term benefits for electric vehicle expenses; however, this might result in insufficient investment down the line.

The report indicated that battery pack prices decreased across all markets. However, the most significant reductions occurred in China—as one might expect. holds a substantial advantage in the battery competition , both for ensuring the stability of the supply chain and advancing technology as a whole.

According to the study, China accounted for 80% of worldwide battery cell production in 2024, with the rest coming from manufacturers in the United States, the European Union, South Korea, and Japan. The rapid decrease in battery costs and advancements in innovation within China can be attributed to intense competition among producers, which has compressed profit margins for many but also boosted manufacturing efficiency, output rates, and access to a substantial pool of skilled labor.

Notably, the study reveals an unexpected finding: hybrid batteries are actually pricier than electric vehicle (EV) batteries, even though they are considerably smaller. According to the research, “the cost of these components is distributed over a lesser number of battery cells, which drives up the price per kilowatt-hour.” It further states that in 2024, the typical price of a 20 kWh plug-in hybrid electric vehicle (PHEV) battery pack—which represents roughly the globally weighted average for regular plug-in hybrids—matched the expense of a much larger 65 kWh battery pack used in battery electric vehicles (BEVs).

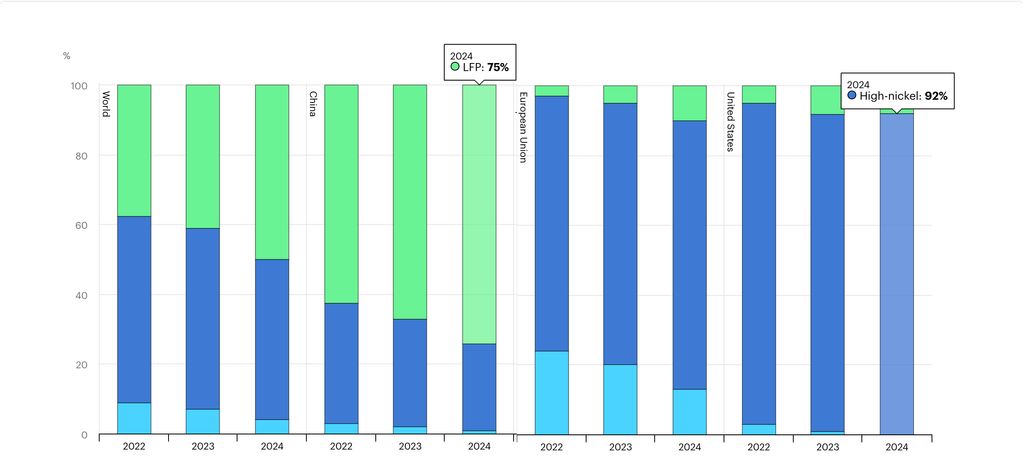

China’s nearly complete dominance in lithium iron phosphate (LFP) batteries is greatly influencing the market. Although LFP batteries were previously seen primarily as an affordable choice for electric vehicles, they have undergone significant improvements due to ongoing advancements, rendering them much better suited for widespread use in everyday cars than before.

Nearly half of the global electric vehicle battery market was comprised of LFP batteries, according to the study, with this trend largely driven by China. In 2024, their usage increased by approximately 90% within the European Union; however, they accounted for just 10% in the United States because of anti-China tariffs. Additionally, LFP batteries seem to be dominating markets around the rest of the globe.

The study noted that the market penetration of LFP batteries is progressing at an accelerated pace in various regions. By 2024, over half of the electric vehicle batteries utilized in Southeast Asia, Brazil, and India were LFP-based. This surge has been fueled primarily by Chinese imports—led notably by BYD—in Southeast Asia and Brazil; conversely, domestic production spearheaded by Tata Motors dominates this trend within India. Additionally, advancements in LFP battery technology are rapidly advancing in both South Korea and Japan.

Here’s some positive and negative news: First off, the U.S. is starting to make progress. According to the research, manufacturing capacity in the country expanded by about 50%, largely driven by South Korean firms attracted by tax incentives, with these companies contributing roughly 70% towards this increase in 2024. This pushed the total installed capacity in the U.S. past that of the EU. Despite this milestone, the EU still saw an uptick of 10% in its manufacturing capacity during the same year; however, this was somewhat offset by the shutdown of the Northvolt facility in Sweden due to bankruptcy issues.

Nevertheless, these tax credits might disappear shortly if President Donald Trump’s proposed budget bill becomes legislation. This comprehensive plan is referred to as the Big, Beautiful Bill. ready to abolish both EV tax incentives and financial benefits for local production of batteries A recent iteration approved by the U.S. House of Representatives reduces both; it is currently progressing through the Senate.

In the end, the worldwide battery surge shows no signs of slowing down. However, it's yet to be determined if America will want to claim a share in this growing market.

Explore the complete research here.

Contact the author: patrick.george@insideevs.com

More Battery News

- Here’s Why Electric Vehicle Batteries Won’t Simply End Up in Landfills

- Bill Ford Issues Caution to Congress Regarding EV Batteries

- CATL Unveils Revolutionary Advance in Battery Longevity

- GM Plans to Introduce LFP Battery Manufacturing in North America: Report

- China's 100-Second Electric Vehicle Battery Swaps Have Arrived

- 'Arrogance': How U.S. Battery Innovations Accelerated China's Electric Vehicle Industry

Post a Comment