Economic Advisor Defends Trump's Tax Bill Amid Disagreements Over Estimates

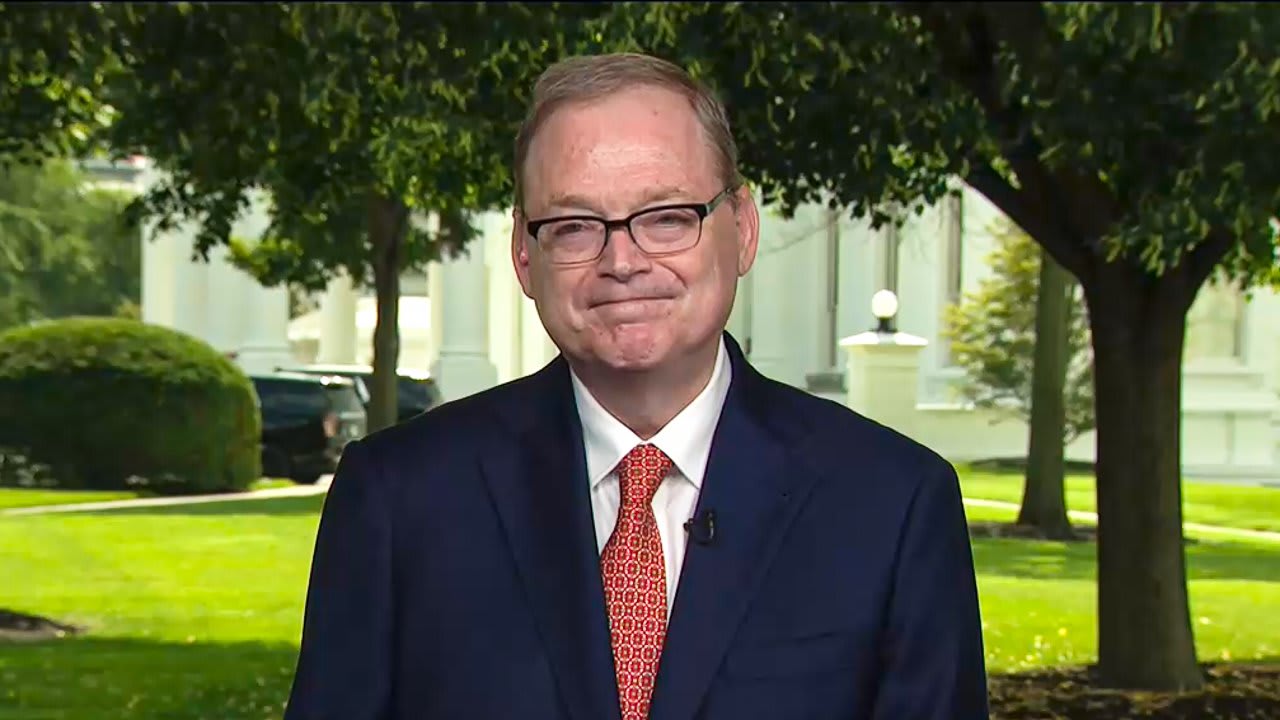

In a recent interview, Kevin Hassett, the White House economic advisor, addressed concerns raised by experts regarding the financial implications of President Donald Trump's proposed tax legislation. Hassett dismissed the warnings from various analysts, emphasizing that "truth" and "science" should not be conflated with democratic processes.

During the conversation with CBS host Weijia Jiang, Hassett was confronted with data from reputable institutions such as the Yale Budget Lab and the Tax Foundation, which estimated that the tax portion of the bill could add up to $3 trillion to the national debt. These figures were presented as evidence of the potential fiscal impact of the proposed changes.

Jiang questioned Hassett about the discrepancy between these estimates and the numbers he had previously shared. She pointed out that multiple independent organizations had reached similar conclusions, suggesting a lack of consensus on the actual effects of the legislation.

Hassett responded by stating that science is not equivalent to democracy. He argued that while there may be a consensus among certain groups about the financial consequences of the bill, his own assessments were based on different methodologies. He mentioned that the models used for previous analyses were applied to this particular tax bill, leading to more favorable outcomes.

He further explained that the models employed by his team were developed during his tenure as chairman of the Council of Economic Advisors. According to Hassett, these models provided a clearer picture of what could happen if the proposed tax changes were implemented, suggesting that they were even more effective in this case.

Hassett also criticized the credibility of some of the institutions that had issued the negative forecasts. He urged them to return to fundamental principles of macroeconomic modeling, implying that their current approach might not be as accurate or reliable as it could be.

The discussion highlighted the ongoing debate over the economic impact of major policy changes. While some experts warn of significant increases in the national deficit, others, like Hassett, believe that the potential for economic growth could offset these concerns. This divergence in perspectives underscores the complexity of evaluating large-scale legislative proposals and the importance of considering multiple viewpoints when assessing their long-term effects.

As the conversation unfolded, it became clear that the interpretation of economic data can vary widely depending on the models and assumptions used. The challenge lies in determining which approach offers the most accurate prediction of future economic conditions. This issue is particularly relevant in the context of high-stakes policy decisions that have far-reaching implications for the economy and the public at large.

In conclusion, the dialogue between Hassett and Jiang reflects the broader discourse surrounding economic policy and the need for transparent, evidence-based analysis. As the debate continues, it remains essential for policymakers and the public to engage with diverse perspectives and critically evaluate the information available to make informed decisions.

Post a Comment