US Private Sector Jobs Decline Sparks Concerns Over Economic Stability

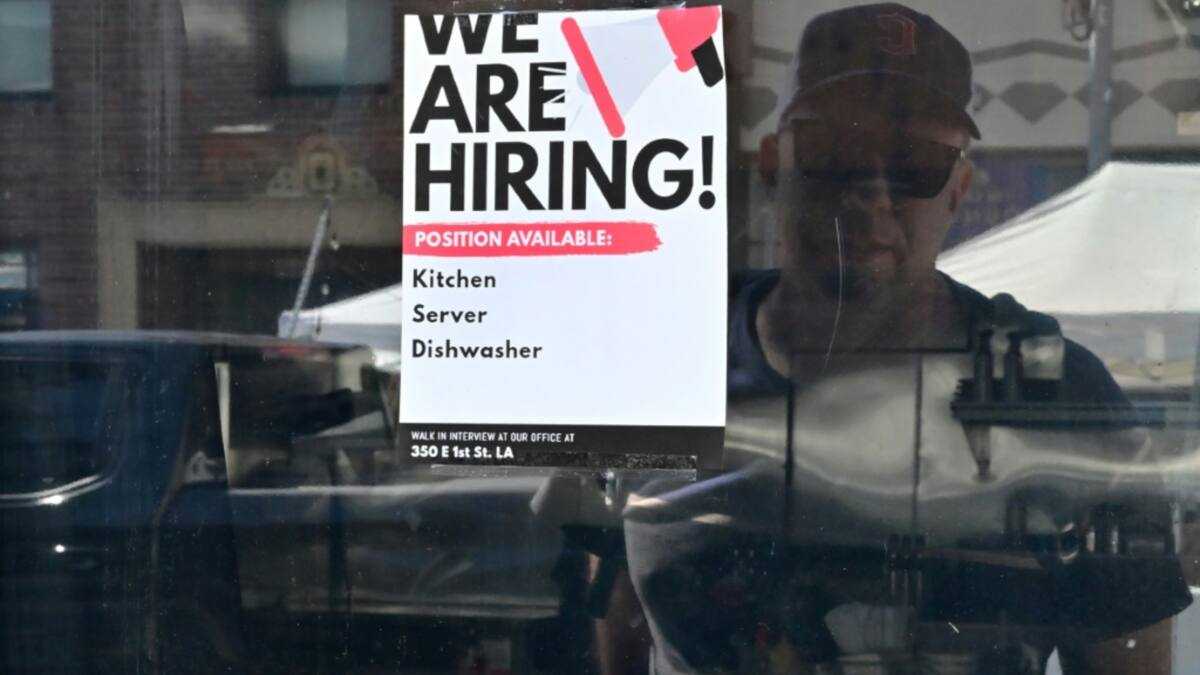

The US private sector experienced an unexpected drop in employment in June, according to data from payroll firm ADP. This decline marks the first such occurrence in recent years and has raised concerns about the strength of the labor market amid ongoing uncertainties linked to President Donald Trump's tariff policies.

The data is being closely examined as it precedes the release of official government employment numbers the following day. Analysts are watching for signs that the world’s largest economy may be showing more weakness than previously anticipated.

ADP reported a decrease of 33,000 jobs in the private sector during June, with May’s job growth also revised downward to 29,000. Nela Richardson, ADP’s chief economist, noted that while layoffs remain uncommon, a reluctance to hire and replace departing workers contributed to the job losses.

Despite the decline, Richardson emphasized that the hiring slowdown has not yet affected pay growth. The report indicated that annual pay increases for those who remained in their jobs stayed steady at 4.4 percent. For individuals who changed jobs, the increase was 6.8 percent, which saw a slight decrease compared to previous months.

The job losses were most evident in sectors such as professional and business services, education, and health services. However, some areas like leisure and hospitality, along with manufacturing, saw positive gains.

This contraction in private sector employment is a significant event, especially when compared to the massive job losses during the pandemic. Historical ADP data also shows a smaller loss in early 2023. However, analysts have pointed out that ADP data often differs from official statistics, making it difficult to fully assess the situation.

Since returning to the presidency, Trump has implemented sweeping tariffs on imports from nearly all US trading partners, with higher rates on steel, aluminum, and automobiles. His approach of announcing, then adjusting or pausing duties, has created uncertainty across supply chains.

Carl Weinberg, chief economist at High Frequency Economics, described the ADP figure as “startling” due to its deviation from market expectations. He warned that traders and investors might interpret the data as a negative signal for the market.

The decline in June was particularly pronounced among smaller and medium-sized businesses, according to ADP data. Jeffrey Roach, chief economist at LPL Financial, suggested that the official jobs report on Thursday could reveal further surprises. While he believes ADP’s monthly forecasts have limited value, he sees potential in using the data to identify long-term trends.

Adam Sarhan from 50 Park Investments noted that this is the first time in recent months that the US jobs market has shown disappointment and contraction. He expressed concern, given the previous stability in unemployment and job growth.

Weinberg cautioned that companies may become more aggressive in reducing their workforce if they anticipate increased costs due to tariffs. He acknowledged that while this could be the beginning of a larger trend, it might also prove to be a temporary setback.

Overall, the unexpected job losses in the private sector have sparked renewed discussions about the resilience of the US economy and the potential impact of ongoing trade policies. As the economic landscape continues to evolve, these developments will likely shape future policy decisions and market reactions.

Post a Comment