- Holcim has been divesting from Kenya and it had a deal to sell its stake in East African Portland Cement (EAPC)

- Kenyan MPs raised concern over the amount that Tanzanian tycoon Edhah Abdallah Munif's company was to purchase the EAPC stake

- Kajiado South MP Samuel Parashina asked EAPC Managing Director Mohammed Osman why the company was not buying back the shares

Elijah Ntongai, an editor at D'moneyTalk.co.ke, has over four years of financial, business, and technology research and reporting experience, providing insights into Kenyan, African, and global trends.

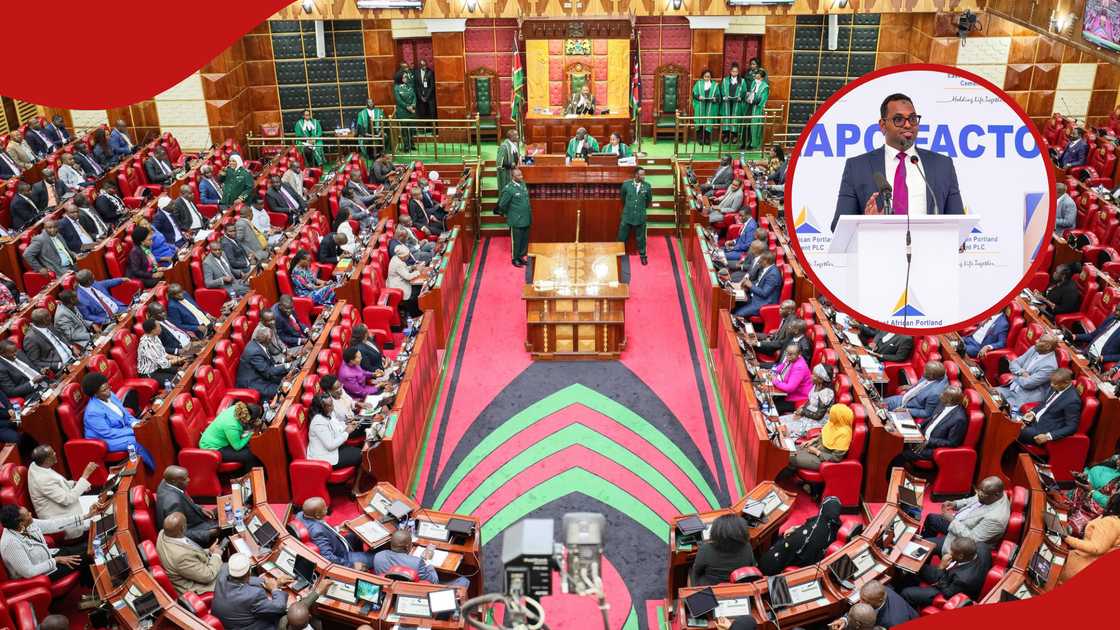

Kenya’s Parliament has moved to halt the planned sale of a significant stake in East African Portland Cement (EAPC) to Tanzanian tycoon Edhah Abdallah Munif.

The legislators raised concerns over the deal that would hand over EAPC shares (PORT) at nearly half the prevailing market price.

The National Assembly Committee on Trade, Industry, and Cooperatives directed EAPC to instead pursue a share buyback of the 29.2% stake currently held by Swiss multinational Holcim.

This will derail Munif’s plan to acquire the shares through his investment vehicle, Kalahari Cement.

Why did MPs block the EAPC stock sale?

Holcim had a deal to sell its 26.32 million shares at KSh 27.30 in a transaction that would have been worth about KSh 718.7 million.

However, the lawmakers raised questions about the agreed share price, which was less than half the current market price of the EACP's stock on the Nairobi Securities Exchange (NSE).

At the close of business on September 16, the EAPC shares were trading around KSh 58.50, which means the Tanzanian tycoon would have acquired the stocks at a discount of more than 50%.

Kajiado South MP Samuel Parashina challenged EAPC’s leadership on the deal, asking why the company was allowing a foreign investor to acquire assets cheaply instead of buying back the shares and reselling them later at a profit.

"Why are you waiting for the shares to be sold? Why not buy it back now?" Parashina asked, as reported by Business Daily.

EAPC Managing Director Mohammed Osman told MPs the company had the financial capacity to undertake the buyback and would comply with approval from the Capital Markets Authority (CMA).

"HOLCIM is exiting the sub-Saharan region, and we are considering a share buyback, which is an option," Osman said.

What is the performance of the EAPC stock?

The EAPC stock has been the best performing at the NSE, having recorded a 385% gain in the last year and 55% in the last six months, trading over KSh 59 per share during the trading session on September 17.

EAPC is considered an undervalued stock because although it has a market capitalisation of about KSh 5.5 billion, its audited financials show a net asset value of KSh 20.4 billion, supported by expansive land holdings worth over KSh 21 billion.

The Competition Authority of Kenya (CAK) and the CMA were also pressed to reject the deal, but CMA chief executive Wyckliffe Shamah told legislators the regulator had no power to dictate the negotiated price between Holcim and Kalahari Cement.

Did the Tanzanian tycoon purchase Bamburi cement?

The intervention comes just months after Munif’s Amsons Group completed the acquisition of the majority stake at Bamburi Cement in a deal that was worth KSh 23.2 billion.

Following the acquisition of Holcim's stake, Amsons Group intensified its push to take full control of Bamburi Cement Plc.

It issued a squeeze-out notice to the remaining 3.46% of shareholders, offering them KSh 65 per share.

Bamburi already owns a 12.5% stake in EAPC, and the purchase of Holcim's stake would have made the Tanzanian businessman the single-largest shareholder of EAPC, with a controlling 41.75% stake.

Post a Comment