- Money Market Funds (MMFs) have emerged as leading investment options in Kenya, holding 64.4% of the Collective Investment Schemes assets.

- Unit Trusts overseeing MMF savings from Kenyans channel these funds into government securities for higher returns.

- According to data from the Central Bank of Kenya (CBK), interest rates on Treasury bills experienced a notable decline in June 2025.

- In an exclusive interview with Smart Tecno.co.ke, financial advisor Alfred Methu highlighted that T-bills are the primary investment tool used by money market funds (MMFs). He pointed out that any decrease in their popularity significantly impacts the returns generated by these funds.

Wycliffe Musalia boasts more than six years of expertise in areas such as finance, business, technology, climate, and health reporting. His work offers valuable perspectives on both Kenya’s and international economic patterns. At present, he serves as a business editor. Smart Tecno.co.ke .

The Central Bank of Kenya (CBK) has published the outcomes for its Treasury Bills with maturities of 91 days, 182 days, and 364 days from the recent auction.

The auction held on June 6, 2025, generated KSh 57.4 billion, exceeding the CBK’s target of KSh 24 billion.

What is the yield on Treasury bills?

Nevertheless, the findings showed a notable decrease in the rate of return falling beneath 10% for the Treasury bill.

The report indicated that the yield on the 91-day bill decreased to 8.2816%, the 182-day bill declined to 8.5433%, whereas the 364-day bill remained at 9.9985%.

This compares to the prior auction where the return rates were 8.2927%, 8.5642%, and 10% respectively.

Could lower yields on Treasury bills impact money market funds?

Speaking exclusively to Smart Tecno.co.ke Financial advisor Alfred Methu pointed out that a decrease in T-bill yields significantly impacts Money Market Funds (MMFs).

Methu stated that the largest investment instrument for MMFs in Kenya is T-bills.

"The primary investment vehicle in MMFs tends to be T-bills. If the returns on these Treasury bills decrease, it will pull down the interest rates of MMFs," he explained.

Previously, Methu observed that MMFs have become more popular in the nation, attributed to heightened financial literacy along with current market circumstances that appeal to Kenyan investors.

Which money market funds experienced a decline due to the decrease in T-bill returns?

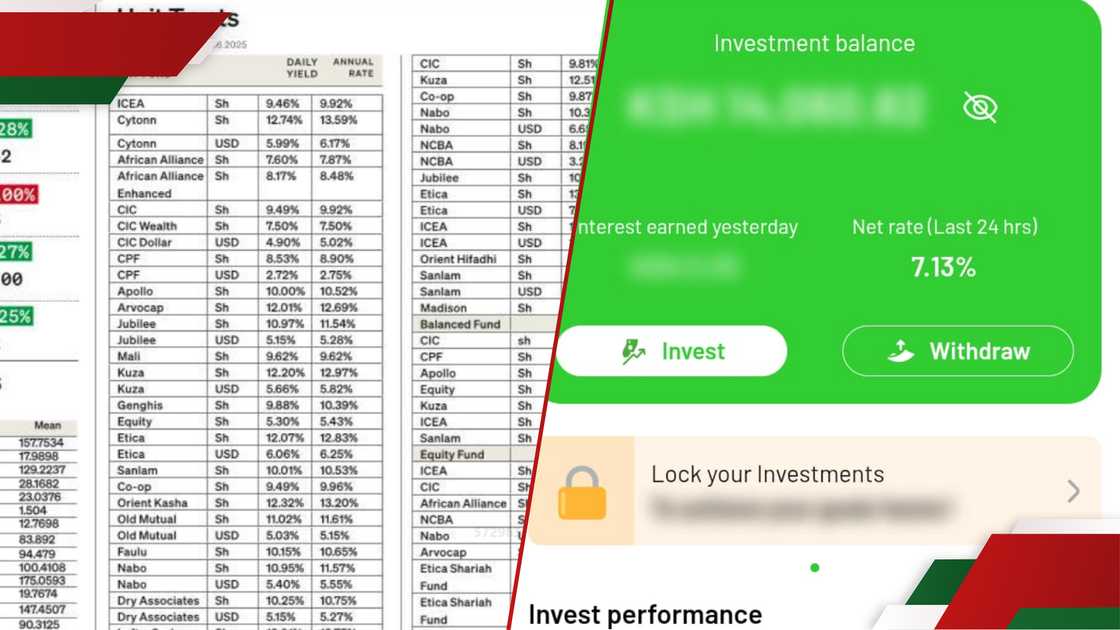

Based on the information provided in the local newspaper on Monday, June 9, these MMFs report daily rates under 10% according to Unit Trust data.

| MMF | Daily rate (%) |

| 1. The ICEA Money Market Fund | 9.46 |

| 2. African Union Money Market Fund | 7.6 |

| 3. Reinforced African Coalition Money Market Fund | 8.17 |

| 4. CIC Cash Management Fund | 9.49 |

| 5. The CIC Wealth Money Market Fund | 7.5 |

| 6. CPF Cash Management Fund | 8.53 |

| 7. Malian Money Market Fund | 9.62 |

| 8. Genghis Capital Money Market Fund | 9.88 |

| 9. Equity Money Market Fund | 5.3 |

| 10. Ziidi Money Market Fund | 7.13 |

| 11. Cooperative Money Market Fund | 9.49 |

What are the leading money market funds (MMFs) in Kenya?

Based on the Capital Markets Authority (CMA) report, MMFs in Kenya manage KSh 319.7 billion, which constitutes 64.4% of all Collective Investment Schemes.

Post a Comment